Unclaimed Property Finder: Your Ultimate Guide To Discovering Hidden Wealth

Imagine this—you’ve been sitting on a treasure trove without even knowing it. Yes, we’re talking about unclaimed property, and it’s more common than you think. Whether it’s forgotten bank accounts, lost stocks, or even old insurance policies, millions of dollars are just waiting for their rightful owners to claim them. And guess what? It could be yours.

Let’s break it down. Unclaimed property refers to any financial asset that has been inactive or unattended for a certain period, usually determined by state laws. This can range from cash left in savings accounts to uncashed checks, and even physical items like safe deposit boxes. If you’ve ever moved, changed jobs, or lost track of financial details, there’s a good chance you’ve got something out there with your name on it.

And here’s the kicker—states across the U.S. have billions in unclaimed funds just sitting around. Seriously, we’re talking big numbers. According to the National Association of Unclaimed Property Administrators (NAUPA), there’s over $42 billion in unclaimed property nationwide. That’s a lot of dough, my friend. So, why not take a shot at finding what might belong to you?

What Exactly is Unclaimed Property?

Unclaimed property, in its simplest form, is anything of monetary value that has been left untouched or unclaimed by its rightful owner for a specified period. This can include:

- Bank accounts and safe deposit boxes

- Pensions and retirement funds

- Stocks, dividends, and uncashed checks

- Insurance policies and refunds

- Utility deposits and gift cards

These items are typically turned over to the state after a dormancy period, which varies depending on the type of property and state regulations. Once the property is handed over, it becomes the responsibility of the state to reunite it with its rightful owner. But here’s the thing—many people don’t even know they have unclaimed property out there.

Why Should You Care About Unclaimed Property?

Well, let’s be real—free money, anyone? If you’ve ever had a job, opened a bank account, or bought a gift card, there’s a chance you’ve got some unclaimed property lurking around. And who wouldn’t want to recover lost funds, right? But it’s not just about the cash. Unclaimed property can also include important documents, like birth certificates or family heirlooms, stored in safe deposit boxes.

Plus, it’s not just individuals who benefit. Businesses can also recover unclaimed property, which can help improve their bottom line. For example, if a company has forgotten about an old investment account or unused gift cards, reclaiming those funds can make a significant difference in their financial health.

How Does Unclaimed Property End Up Lost?

It’s easier than you think. Life happens, people move, and things get forgotten. Here are some common reasons why property becomes unclaimed:

- Moving: When people relocate, they often lose track of financial accounts or safe deposit boxes.

- Changing Jobs: Forgotten 401(k) plans or unused vacation pay can easily slip through the cracks.

- Death in the Family: Beneficiaries might not know about assets left behind by loved ones.

- Bankruptcies or Business Closures: Companies may fail to return deposits or refunds to customers.

And sometimes, it’s just plain old human error. A typo in an account number or a misplaced check can lead to property being labeled as unclaimed. It happens more often than you’d think.

How to Search for Unclaimed Property

Searching for unclaimed property is easier than ever, thanks to digital tools and state databases. Here’s how you can start your hunt:

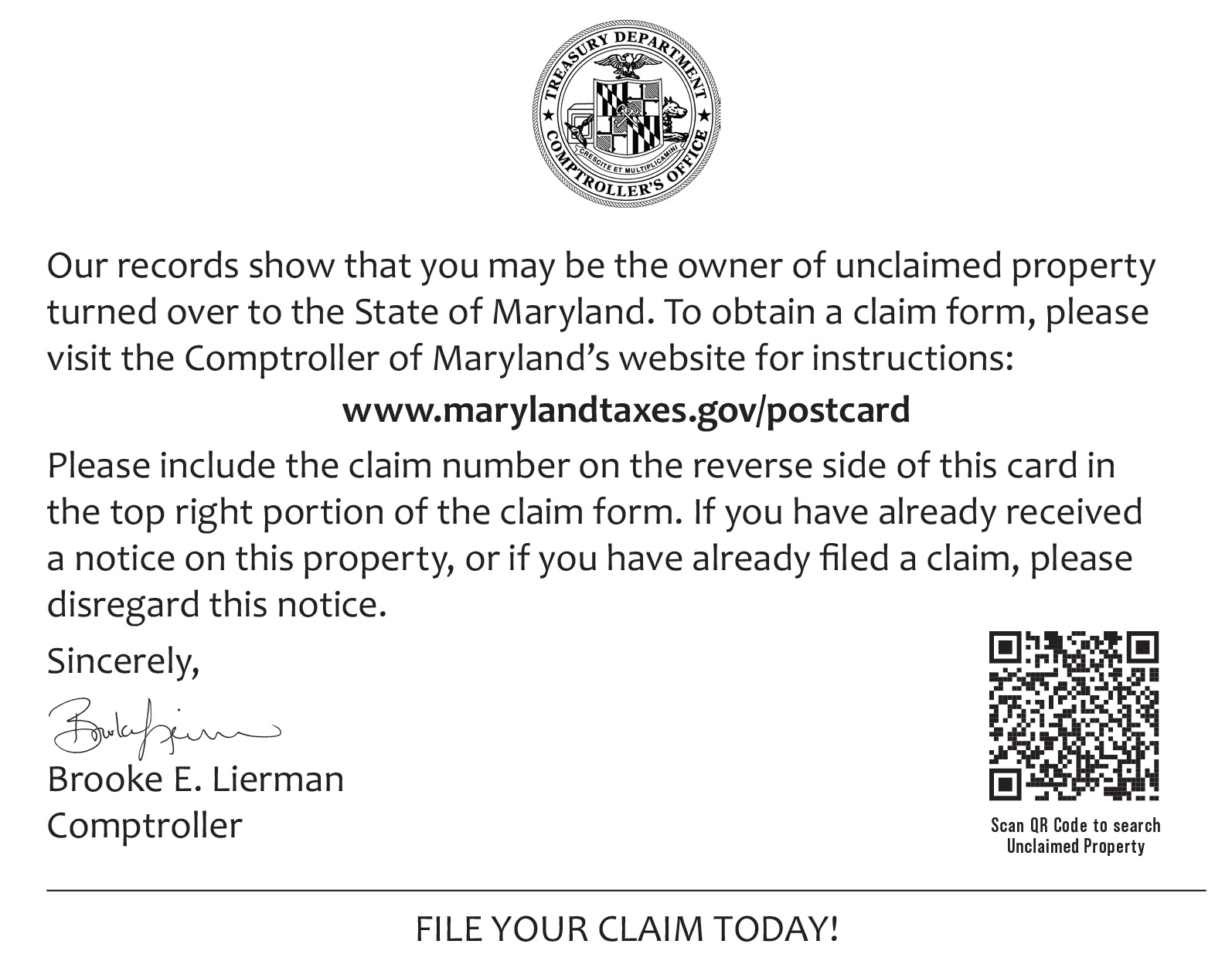

Step 1: Check State Databases

Every state in the U.S. maintains a database of unclaimed property. You can usually access this information through the state’s official website. Just enter your name, and voila! You might be surprised by what pops up.

Step 2: Use National Databases

For a more comprehensive search, consider using national databases like USA.gov or MissingMoney.com. These platforms allow you to search multiple states at once, making the process much faster.

Step 3: Contact Financial Institutions

If you suspect you have unclaimed property with a specific bank or insurance company, don’t hesitate to reach out directly. They may have records of dormant accounts or policies that haven’t been claimed yet.

Common Types of Unclaimed Property

Now that you know how to search, let’s dive into the most common types of unclaimed property:

- Bank Accounts: Savings, checking, or certificates of deposit that haven’t been accessed in years.

- Safe Deposit Boxes: Items stored in bank vaults that have been abandoned.

- Pensions: Forgotten retirement funds from former employers.

- Stocks and Dividends: Unclaimed shares or payments from investments.

- Insurance Policies: Life insurance policies where beneficiaries weren’t properly notified.

Each of these categories requires a slightly different approach to reclaim, but the process is generally straightforward once you know where to look.

Legal Aspects of Unclaimed Property

It’s important to understand the legal framework surrounding unclaimed property. States have specific laws governing how long property can remain dormant before being escheated, or turned over to the state. This period is known as the dormancy period and can range from one to five years, depending on the type of property and state regulations.

Once property is escheated, it becomes the responsibility of the state to locate the rightful owner. However, the original owner always retains the right to claim their property, no matter how long it’s been unclaimed. This is why it’s crucial to periodically check for unclaimed property, even if you think you’ve accounted for everything.

How to Claim Your Unclaimed Property

Claiming unclaimed property is relatively simple, but it does require some paperwork. Here’s what you’ll need to do:

Step 1: Gather Documentation

Be prepared to provide proof of identity and ownership. This might include:

- A valid ID, such as a driver’s license or passport

- Bank statements or other financial records

- Documentation showing a connection to the property

Step 2: Submit a Claim Form

Most states offer online claim forms that you can fill out directly on their website. Be sure to provide all required information and attach any necessary documentation.

Step 3: Wait for Processing

Once your claim is submitted, it may take several weeks or even months to process. Patience is key here, but rest assured that if your claim is valid, you’ll eventually receive your property.

Unclaimed Property Statistics

Here are some eye-opening stats about unclaimed property in the U.S.:

- Over $42 billion in unclaimed property is currently held by states nationwide.

- The average unclaimed property claim is around $1,000.

- California alone holds over $9 billion in unclaimed funds.

- More than 1 in 10 Americans has unclaimed property waiting for them.

These numbers highlight just how widespread the issue of unclaimed property really is. With billions of dollars up for grabs, it’s worth taking the time to see if any of it belongs to you.

Tools and Resources for Finding Unclaimed Property

There are plenty of tools and resources available to help you in your search for unclaimed property:

- State Websites: Every state has its own database of unclaimed property. Start your search there.

- National Databases: Platforms like USA.gov and MissingMoney.com can simplify the process.

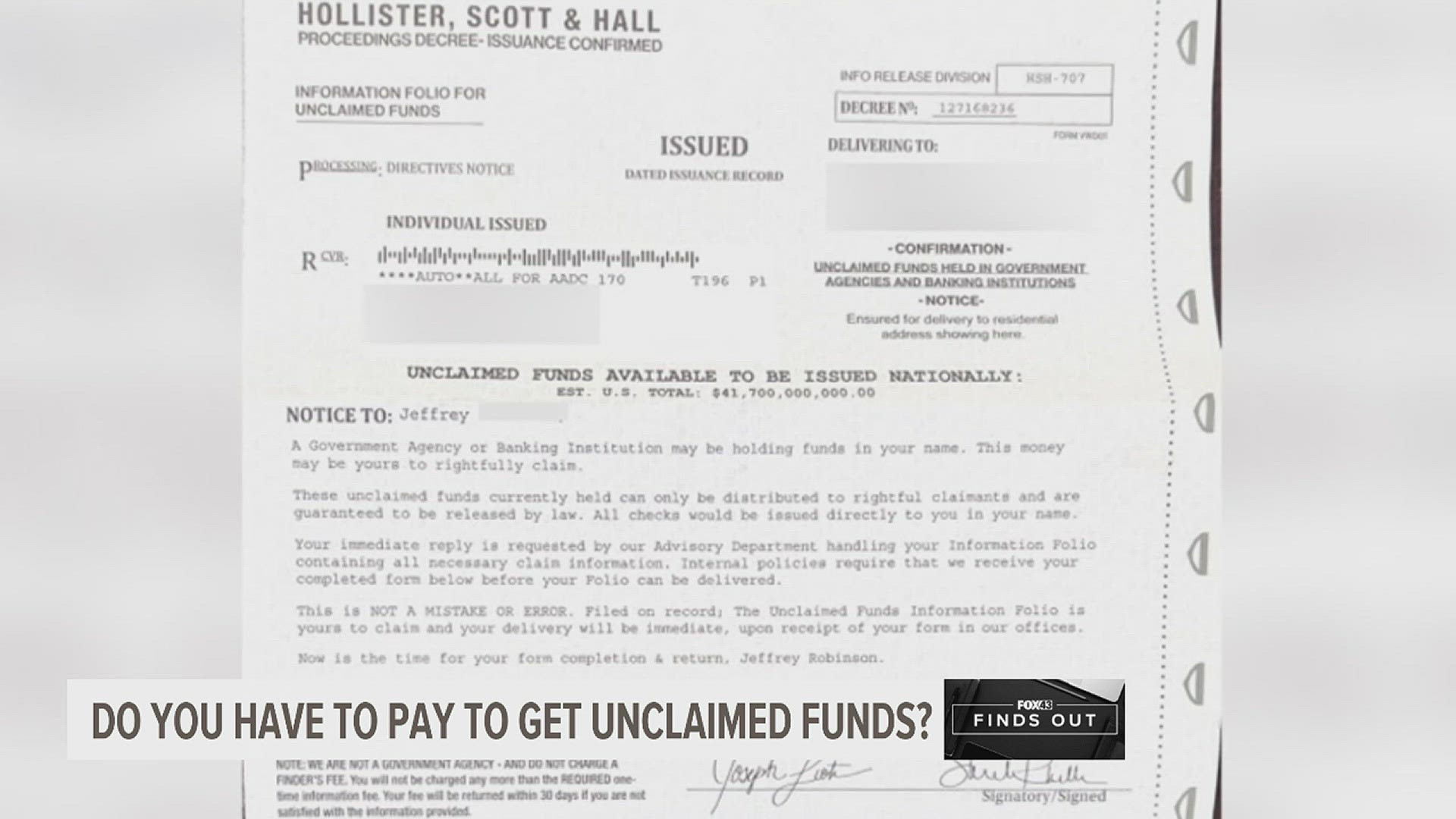

- Third-Party Services: Some companies specialize in helping people recover unclaimed property, though be cautious of fees.

When using third-party services, make sure they’re reputable and transparent about their fees. Many states offer free resources, so it’s often best to start there before turning to paid services.

Preventing Unclaimed Property in the Future

While finding unclaimed property is exciting, it’s also important to take steps to prevent it from happening in the first place:

- Keep Track of Accounts: Regularly review your financial accounts and update your information with banks and employers.

- Notify Beneficiaries: Make sure loved ones know about any assets or policies you have in place.

- Organize Important Documents: Keep a centralized location for all your financial and legal papers.

A little bit of organization can go a long way in avoiding lost or forgotten property down the line.

Final Thoughts: Time to Start Your Hunt

So, there you have it—everything you need to know about unclaimed property. Whether you’re looking to recover lost funds or simply want to ensure your financial affairs are in order, understanding unclaimed property is a crucial step. Remember, billions of dollars are just sitting out there, waiting for their rightful owners. Why not see if some of it belongs to you?

Don’t forget to share this article with friends and family. You never know who might benefit from the information. And if you’ve had success in reclaiming unclaimed property, leave a comment below—we’d love to hear your story!

Table of Contents

- What Exactly is Unclaimed Property?

- Why Should You Care About Unclaimed Property?

- How Does Unclaimed Property End Up Lost?

- How to Search for Unclaimed Property

- Common Types of Unclaimed Property

- Legal Aspects of Unclaimed Property

- How to Claim Your Unclaimed Property

- Unclaimed Property Statistics

- Tools and Resources for Finding Unclaimed Property

- Preventing Unclaimed Property in the Future

Unclaimed Property

Patreasury Unclaimed Property Dept

is legitimate or a scam?