Los Angeles County Property Taxes: A Comprehensive Guide To Understanding Your Obligations

Alright, let’s cut to the chase, folks—property taxes in Los Angeles County can be a real head-scratcher. Whether you’re a first-time homeowner or a seasoned real estate investor, navigating the ins and outs of property tax laws can feel like trying to decode ancient hieroglyphics. But don’t panic just yet! This guide is here to break it all down for you, step by step, so you can make sense of those tax bills without losing your cool.

Now, I know what you’re thinking—“Why do I even need to know this stuff?” Well, here’s the deal: property taxes are one of the biggest expenses homeowners face, and understanding them can save you a ton of money in the long run. Ignoring them, on the other hand, could lead to some serious consequences, like penalties, interest charges, or even losing your property altogether. Yikes!

So, buckle up because we’re diving deep into everything you need to know about Los Angeles County property taxes. From how they’re calculated to ways you can reduce your bill, we’ve got you covered. Let’s get started!

Table of Contents

- What Are Property Taxes?

- How Property Taxes Are Calculated

- Key Players in the Property Tax System

- Important Dates and Deadlines

- Common Mistakes to Avoid

- Ways to Reduce Your Property Tax Bill

- Property Tax Exemptions and Relief Programs

- Understanding Assessment Appeals

- Frequently Asked Questions

- Conclusion and Next Steps

What Are Property Taxes?

Alright, let’s start with the basics. Property taxes are essentially fees that homeowners pay to local governments, like Los Angeles County, to fund public services. These services include things like schools, parks, fire departments, and infrastructure projects. Think of it as your contribution to keeping the neighborhood running smoothly.

But here’s the kicker—property taxes aren’t optional. They’re a legal obligation, and failing to pay them can land you in hot water. The amount you owe depends on the assessed value of your property and the local tax rate, which we’ll dive into later.

Now, you might be wondering, “Why do they call it ‘ad valorem’ tax?” Well, that’s just fancy Latin for “according to value.” It means the tax is based on the value of your property. Simple, right? Or maybe not so much. Let’s break it down further in the next section.

How Property Taxes Are Calculated

Understanding Property Value Assessment

Here’s the deal: your property tax bill is calculated by multiplying the assessed value of your property by the tax rate set by Los Angeles County. But hold up—what exactly is assessed value?

Assessed value is basically the estimated market value of your property, but it’s usually a percentage of the actual market value. In California, thanks to Proposition 13, properties are generally assessed at their purchase price, and the assessed value can only increase by a maximum of 2% per year unless there’s a change in ownership or new construction.

So, let’s say you bought a house for $500,000. Your assessed value would start at $500,000, and it could only go up by 2% each year. If the tax rate is 1%, your property tax bill would be $5,000 for the first year. Easy peasy, right?

Factors That Affect Property Taxes

- Location: Properties in more desirable areas tend to have higher assessed values, which means higher taxes.

- Property Type: Residential, commercial, and industrial properties are taxed differently.

- Improvements: Adding a pool, remodeling your kitchen, or building an extension can increase your assessed value—and your tax bill.

- Market Conditions: If property values in your area are rising, your assessed value might increase too, even with the 2% cap.

Keep in mind that these factors can fluctuate over time, so it’s important to stay informed about any changes that might affect your property taxes.

Key Players in the Property Tax System

Alright, let’s meet the team behind the scenes. There are a few key players involved in the property tax process in Los Angeles County:

- Assessor: This is the person responsible for determining the assessed value of your property. They use data like sales comparisons and cost approaches to come up with an accurate estimate.

- Tax Collector: Think of them as the bill collectors. They’re the ones who send out your tax bills and keep track of payments.

- Board of Equalization: If you feel like your assessed value is unfair, you can appeal to this board for a review.

Knowing who these folks are and what they do can help you navigate the system more effectively. Plus, it never hurts to be polite when dealing with government officials, am I right?

Important Dates and Deadlines

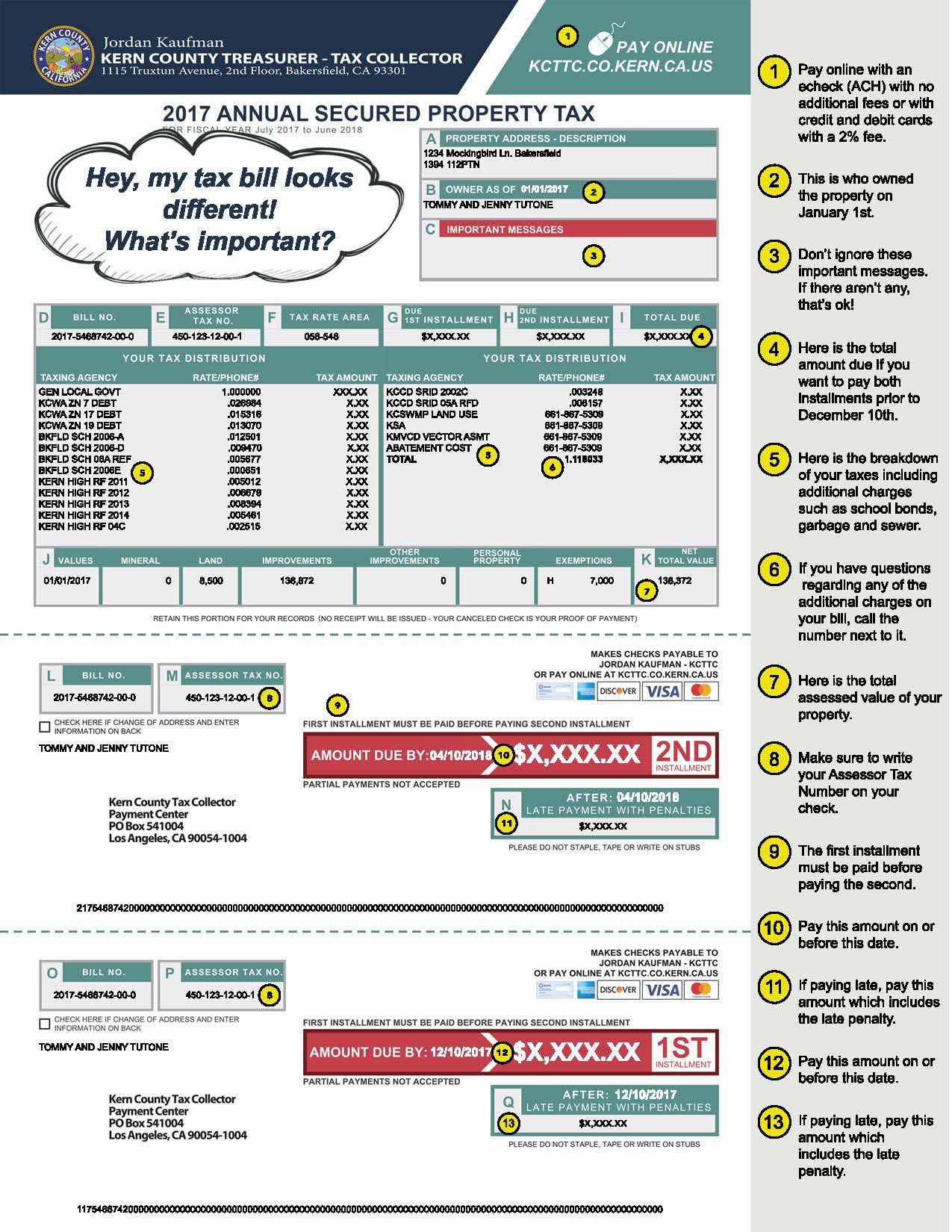

Now, let’s talk about timing. Property taxes in Los Angeles County are due in two installments:

- First Installment: Due by December 10th.

- Second Installment: Due by April 10th.

If you miss these deadlines, you’ll face late fees and interest charges, so mark your calendar! You can pay your taxes online, by mail, or in person at the Tax Collector’s office. Just make sure you have proof of payment in case anything goes wrong.

Common Mistakes to Avoid

Here are a few blunders that could cost you big time:

- Ignoring Your Tax Bill: This is a recipe for disaster. Late payments can lead to penalties and even property liens.

- Not Reviewing Your Assessed Value: Sometimes assessors make mistakes. If you notice an error, don’t hesitate to dispute it.

- Missing Exemption Deadlines: Many homeowners qualify for exemptions, but you have to apply by the deadline to take advantage of them.

Avoiding these pitfalls can save you a ton of hassle and money, so stay vigilant!

Ways to Reduce Your Property Tax Bill

Apply for Exemptions

There are several exemptions available to homeowners in Los Angeles County. Here are a few:

- Homeowner’s Exemption: This reduces your assessed value by $7,000 if you use the property as your primary residence.

- Senior Citizen Exemption: If you’re 55 or older, you might qualify for a reduced tax rate.

- Disability Exemption: Certain disabilities may qualify you for a tax break.

Appeal Your Assessment

If you think your assessed value is too high, you can file an appeal with the Los Angeles County Board of Equalization. Gather evidence, like comparable property sales, to support your case. It’s a bit of a hassle, but it could be worth it if you’re overpaying.

Property Tax Exemptions and Relief Programs

Besides the exemptions we mentioned earlier, there are other relief programs that might help you lower your property tax bill:

- Californians for Homeowner Protection: This program offers assistance to homeowners facing financial hardship.

- Supplemental Assessments: If you’ve made improvements to your property, you might be eligible for a temporary reduction in your tax bill.

Do your research and see if any of these programs apply to your situation. Every little bit helps!

Understanding Assessment Appeals

Appealing your property assessment might sound intimidating, but it’s not as bad as it seems. Here’s how it works:

- Review your assessment notice carefully.

- Gather evidence to support your claim, like recent sales of similar properties in your area.

- File an appeal with the Los Angeles County Board of Equalization by the deadline.

- Attend the hearing and present your case.

If the board agrees with you, they’ll adjust your assessed value accordingly. If not, you can always take it to the next level by filing a lawsuit, but that’s usually a last resort.

Frequently Asked Questions

Let’s tackle some of the most common questions homeowners have about Los Angeles County property taxes:

- Can I pay my property taxes in one lump sum? Yes, you can, but you’ll still need to pay by the deadlines for each installment.

- What happens if I don’t pay my property taxes? You’ll face penalties, interest charges, and eventually, a tax lien on your property.

- How often are property values reassessed? In California, properties are reassessed only when there’s a change in ownership or new construction.

Conclusion and Next Steps

Alright, folks, that’s the lowdown on Los Angeles County property taxes. By now, you should have a pretty good understanding of how they work, how to calculate your bill, and ways to reduce your expenses. Remember, staying informed and proactive is key to managing your property taxes effectively.

So, what’s next? Here’s what I recommend:

- Review your recent tax bill and compare it to your property’s assessed value.

- Check if you qualify for any exemptions or relief programs.

- Stay on top of important dates and deadlines to avoid penalties.

And hey, if you found this guide helpful, don’t forget to share it with your friends and family. Knowledge is power, especially when it comes to property taxes. Until next time, keep those wallets closed and those minds sharp!

THE TREASURER AND TAX COLLECTOR CONTINUES TO MAIL THE 2024 ANNUAL

Los Angeles County Property Tax Website

la county tax collector mailing address Vinita Witt