DoubleYourLine Credit Card: Unlock The Power Of Smart Finance

Imagine this—you're standing at the checkout counter, ready to grab that dream gadget or vacation package, but your wallet's feeling a little light. Enter DoubleYourLine Credit Card, the ultimate financial tool designed to help you live smarter, not harder. Whether you're a savvy spender or just starting your credit journey, this card offers more than just swipes—it’s about building a better financial future.

Now, let's be real. Not all credit cards are created equal. Some come with hidden fees, sky-high interest rates, and complicated terms that make your head spin. But DoubleYourLine? It's different. It’s like having a personal finance assistant in your pocket, one that actually works for you, not against you. So, why wait? Let's dive into what makes this card a game-changer in the world of credit.

In this article, we'll break down everything you need to know about DoubleYourLine Credit Card. From its amazing benefits to how it stacks up against other cards, we've got you covered. By the end of this, you'll be armed with the knowledge to make the best financial decision for your life. So, buckle up, and let's get started!

Here’s a quick table of contents to help you navigate:

- What is DoubleYourLine Credit Card?

- Top Benefits of DoubleYourLine Credit Card

- Who Can Get a DoubleYourLine Credit Card?

- How to Apply for DoubleYourLine Credit Card

- Fees and Interest Rates

- DoubleYourLine Rewards Program

- Security Features You Can Trust

- How DoubleYourLine Stacks Up Against Competitors

- Tips for Using DoubleYourLine Wisely

- Frequently Asked Questions About DoubleYourLine

What is DoubleYourLine Credit Card?

Alright, let’s start with the basics. What exactly is DoubleYourLine Credit Card? Think of it as your financial superpower. This card isn’t just another piece of plastic in your wallet—it’s a strategic tool designed to help you manage your finances smarter and more effectively. It offers a range of features that cater to both everyday spending and big-ticket purchases, making it a versatile option for anyone looking to maximize their credit potential.

One of the coolest things about DoubleYourLine is its flexibility. Whether you're consolidating debt, financing a big purchase, or simply looking for a card that rewards you for everyday spending, this card has got your back. Plus, it comes with some killer perks, like cashback, travel rewards, and exclusive discounts. We'll get into those later, but trust us—it’s worth the read!

Why DoubleYourLine Stands Out

Here’s the deal: DoubleYourLine isn’t just about offering credit. It’s about empowering you to take control of your financial life. The card is designed with modern consumers in mind, blending convenience, security, and rewards in a way that traditional cards just can’t match. So, whether you're a tech-savvy millennial or a seasoned finance pro, this card offers something for everyone.

Top Benefits of DoubleYourLine Credit Card

Let’s cut to the chase—why should you care about DoubleYourLine Credit Card? Well, because it’s packed with features that make your life easier, smarter, and more rewarding. Here are some of the top benefits you’ll enjoy as a cardholder:

- No Annual Fee: Yep, you heard that right. DoubleYourLine waives the annual fee, so you can enjoy all the perks without the added cost.

- Generous Rewards: Earn points for every dollar you spend, which can be redeemed for travel, gift cards, or even cashback. It’s like getting paid to shop!

- Low Interest Rates: Compared to other cards, DoubleYourLine offers competitive interest rates, helping you save money in the long run.

- Flexible Payment Options: Whether you prefer to pay monthly or take advantage of extended payment plans, this card gives you the flexibility to manage your finances your way.

- 24/7 Customer Support: Got a question or concern? DoubleYourLine’s customer service team is available around the clock to assist you.

These benefits aren’t just fluff—they’re designed to help you save money, earn rewards, and take control of your financial future. And hey, who doesn’t love that?

Who Can Get a DoubleYourLine Credit Card?

So, you’re probably wondering—am I eligible for DoubleYourLine Credit Card? The good news is, this card is designed to be inclusive. While specific eligibility criteria may vary, here are some general guidelines:

Credit Score: While having a good credit score can increase your chances of approval, DoubleYourLine also considers other factors, like income and financial history. So, even if your score isn’t perfect, you might still qualify.

Income Requirements: You’ll need to demonstrate a stable source of income to qualify. This could be from a full-time job, freelance work, or even passive income sources.

Age: You must be at least 18 years old to apply for the card. If you're younger, you might consider adding a co-signer or starting with a secured credit card.

Bottom line? DoubleYourLine is designed to be accessible to a wide range of people, making it a great option for those looking to build or improve their credit.

How to Apply for DoubleYourLine Credit Card

Ready to take the plunge? Applying for DoubleYourLine Credit Card is easier than you think. Here’s a step-by-step guide to help you through the process:

- Gather Your Info: Before you apply, make sure you have all the necessary documents ready, including proof of income, identification, and your social security number.

- Visit the Website: Head over to DoubleYourLine’s official website and click on the “Apply Now” button. The application process is completely online, so no need to visit a branch.

- Fill Out the Form: The application will ask for basic information, like your name, address, and employment details. Be honest and accurate—this will help speed up the approval process.

- Submit and Wait: Once you’ve completed the form, submit it and wait for a decision. Most applicants receive an answer within minutes, but some cases may require additional review.

Pro tip: If you’re unsure about any part of the application process, don’t hesitate to reach out to DoubleYourLine’s customer service team. They’re there to help!

Fees and Interest Rates

Let’s talk numbers. When it comes to credit cards, fees and interest rates can make or break your experience. Here’s what you need to know about DoubleYourLine:

Purchase APR: DoubleYourLine offers a competitive purchase APR, which is the interest rate applied to your balance if you don’t pay it off in full each month. The exact rate will depend on your creditworthiness, but it’s generally lower than many other cards on the market.

Balance Transfer Fee: If you’re looking to consolidate debt, DoubleYourLine offers a balance transfer option with a low introductory fee. This can help you save money on interest while paying down your balances faster.

Cash Advance Fee: While using your credit card for cash advances isn’t always recommended, DoubleYourLine keeps the fees reasonable. Just remember, cash advances typically come with higher interest rates, so use this feature sparingly.

Remember, the key to avoiding unnecessary fees is to pay your balance on time and in full whenever possible. DoubleYourLine makes it easy with automatic payment reminders and flexible due dates.

DoubleYourLine Rewards Program

Now, let’s talk about the fun part—rewards! DoubleYourLine’s rewards program is designed to reward you for your everyday spending. Here’s how it works:

Earn Points: You’ll earn points for every dollar you spend on your card. The more you use it, the more points you accumulate. These points can be redeemed for a variety of rewards, including:

- Travel: Book flights, hotels, and rental cars using your points. It’s like getting free vacations just for swiping your card!

- Gift Cards: Redeem your points for gift cards to your favorite stores and restaurants.

- Cashback: Prefer cold, hard cash? You can also redeem your points for cashback directly to your account.

Pro tip: Maximize your rewards by using your card for recurring expenses, like groceries and utility bills. It’s an easy way to rack up points without even trying!

Security Features You Can Trust

When it comes to credit cards, security is a top priority. DoubleYourLine understands this and offers a range of features to keep your information safe:

Chip and PIN Technology: Every DoubleYourLine card comes equipped with chip and PIN technology, adding an extra layer of protection against fraud.

24/7 Fraud Monitoring: DoubleYourLine’s fraud detection system works around the clock to monitor your account for suspicious activity. If something seems off, you’ll be notified immediately.

Virtual Card Numbers: When shopping online, you can use a virtual card number to protect your actual card details. It’s a simple yet effective way to stay secure in the digital world.

With these security features in place, you can use your DoubleYourLine Credit Card with confidence, knowing your information is protected.

How DoubleYourLine Stacks Up Against Competitors

So, how does DoubleYourLine compare to other credit cards on the market? Let’s break it down:

Against High-Interest Cards: DoubleYourLine offers lower interest rates compared to many high-interest cards, making it a smarter choice for those looking to save money.

Against Reward Cards: While some reward cards offer flashy perks, DoubleYourLine’s rewards program is designed to be practical and accessible. You don’t need to jump through hoops to earn and redeem points—just use your card as you normally would.

Against Secured Cards: If you’re rebuilding credit, DoubleYourLine offers a better alternative to secured cards. With no deposit required and a range of features to help you build credit, it’s a more convenient option for many people.

At the end of the day, DoubleYourLine stands out because it’s designed to meet the needs of real people, not just bank profits.

Tips for Using DoubleYourLine Wisely

Having a great credit card is one thing, but using it wisely is another. Here are some tips to help you make the most of your DoubleYourLine Credit Card:

- Pay Your Balance in Full: Avoid interest charges by paying off your balance each month. It’s the simplest way to save money and build credit.

- Track Your Spending: Use DoubleYourLine’s app or online portal to monitor your spending and stay within budget.

- Take Advantage of Rewards: Don’t let those points go to waste! Redeem them regularly for travel, gift cards, or cashback.

- Stay Secure: Protect your card by using strong passwords, enabling fraud alerts, and keeping your information up to date.

By following these tips, you’ll not only make the most of your card but also set yourself up for financial success in the long run.

Frequently Asked Questions About DoubleYourLine

Still have questions? Here are some common queries about DoubleYourLine Credit Card:

Q: Is there an annual fee? A: No, DoubleYourLine Credit Card does not charge an annual fee.

Q: How long does it take to get approved? A: Most applicants receive a decision within minutes, but some cases may require additional review.

Q: Can I use my points for anything?

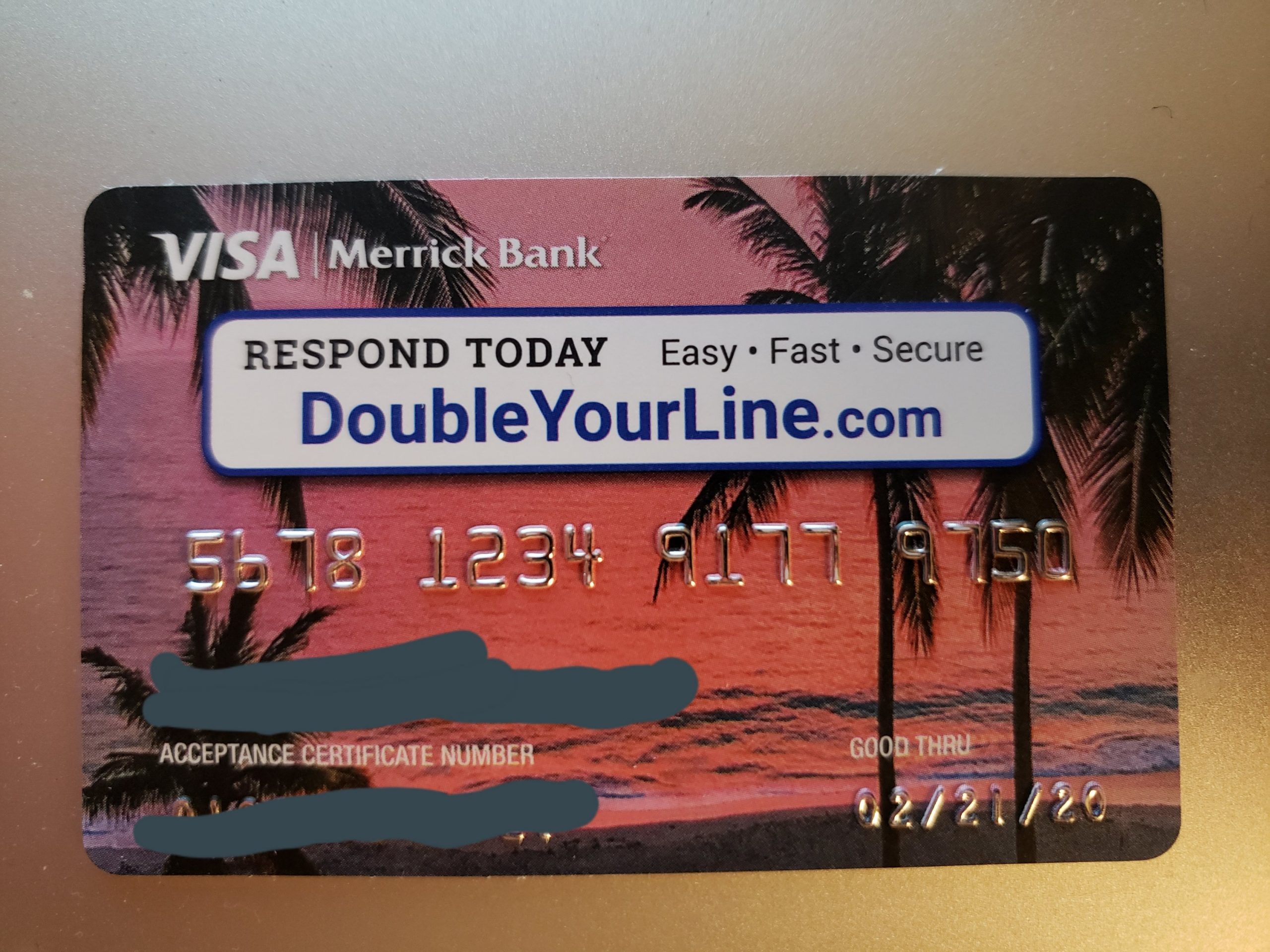

Merrick Bank Visa Card Offer Card Rewards Network

How to double your line of credit on your card by Lease Funders Issuu

Merrick Bank Double Your Line PreApproval mail of... myFICO® Forums