Los Angeles County Tax Collector Property Tax: A Comprehensive Guide For Every Homeowner

Are you tired of feeling lost when it comes to understanding property taxes in Los Angeles County? Well, let me tell you, you're not alone. Property taxes can be a real headache, but they don’t have to be. Today, we’re diving deep into the world of Los Angeles County Tax Collector property tax. Whether you’re a first-time homeowner or a seasoned property owner, this guide is here to help you navigate the complexities of property taxes like a pro.

Let’s be honest, paying taxes is never fun. But understanding how they work and what’s expected of you can make the process smoother. Los Angeles County Tax Collector is the main authority responsible for collecting property taxes. And guess what? Knowing how it operates and what you need to do can save you from unnecessary penalties and stress.

This article will break down everything you need to know about property taxes in LA County, from how they’re calculated to deadlines and exemptions. So, grab your favorite drink, sit back, and let’s tackle this together. Trust me, by the end of this read, you’ll feel like a property tax guru!

Understanding the Role of Los Angeles County Tax Collector

The Los Angeles County Tax Collector plays a crucial role in managing property taxes for residents. They are responsible for ensuring that property owners pay their fair share based on the assessed value of their properties. But what exactly does this mean for you? Let’s dig deeper.

Who Is the Los Angeles County Tax Collector?

The Tax Collector is essentially the gatekeeper of property tax collection in LA County. They ensure that all properties are assessed correctly and that taxes are collected on time. This department works closely with the Assessor’s Office to determine property values and distribute tax bills accordingly.

- They handle property tax assessments.

- They issue tax bills to property owners.

- They collect payments and manage delinquent accounts.

Understanding their role is key to staying compliant and avoiding any unwanted surprises come tax season.

How Property Taxes Are Calculated in Los Angeles County

Now that we’ve got the basics down, let’s talk about how property taxes are calculated. This is where things get a bit technical, but don’t worry, I’ll break it down for you.

Key Factors Influencing Property Tax Rates

Property taxes in LA County are based on several factors, including the assessed value of your property, local tax rates, and any applicable exemptions. Here’s a quick rundown:

- Assessed Value: This is the value assigned to your property by the Assessor’s Office. It’s usually a percentage of the market value.

- Tax Rate: The tax rate varies depending on the location and type of property. In LA County, the base rate is typically around 1% of assessed value.

- Exemptions: Homeowners may qualify for certain exemptions, such as the Homeowner’s Exemption, which can reduce your taxable value.

It’s important to note that these factors can change over time, so staying informed is key.

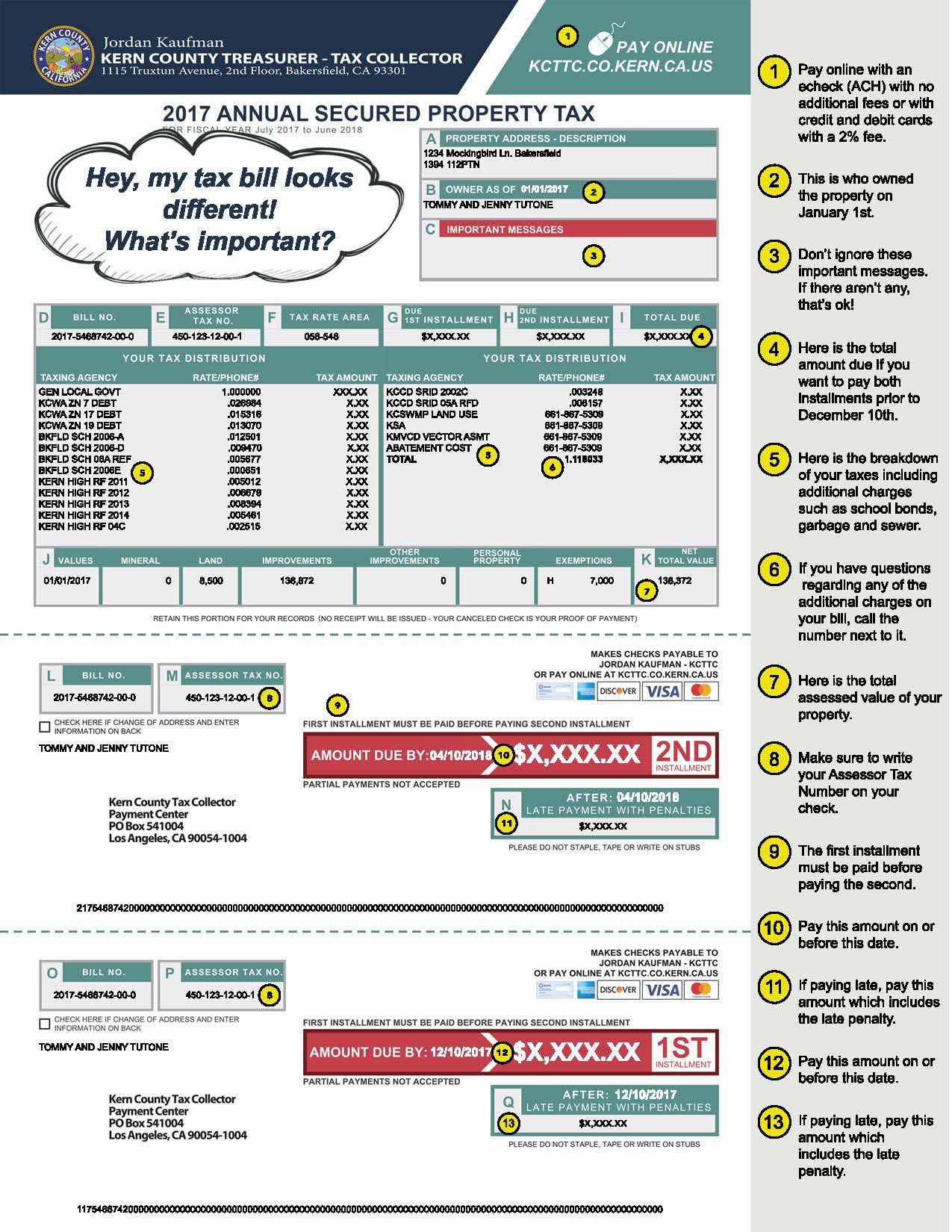

Property Tax Deadlines You Need to Know

Missing deadlines can lead to penalties and interest charges, so it’s crucial to keep track of important dates. The Los Angeles County Tax Collector sets specific deadlines for paying property taxes, and here’s what you need to remember:

Important Dates for Property Tax Payments

- First Installment: Due on November 1 and delinquent after December 10.

- Second Installment: Due on February 1 and delinquent after April 10.

Pay attention to these dates to avoid any unnecessary fees. If you’re unable to pay on time, reach out to the Tax Collector’s Office to explore payment options.

Exemptions and Deductions for Property Owners

Let’s talk about some good news – exemptions and deductions! Depending on your situation, you might qualify for certain reductions in your property tax bill. Here are a few common ones:

Homeowner’s Exemption

This exemption allows homeowners to reduce their taxable value by $7,000. It’s available to those who use the property as their primary residence. Simple, right?

Senior Citizen Exemption

For senior citizens aged 55 or older, there are additional exemptions available. These can significantly lower your tax burden and make homeownership more affordable in your golden years.

Make sure to check if you qualify for any of these exemptions to save money on your property taxes.

Challenging Your Property Tax Assessment

What happens if you believe your property tax assessment is inaccurate? Don’t worry, you have options. The Los Angeles County Tax Collector provides a process for disputing assessments if you feel they’re unfair.

Steps to File an Appeal

If you want to challenge your assessment, follow these steps:

- Gather evidence to support your case, such as recent property sales in your area.

- Submit a formal appeal to the Assessor’s Office.

- Attend a hearing if necessary to present your case.

It’s a straightforward process, but preparation is key. Make sure you have all the necessary documentation before filing an appeal.

Payment Options for Property Taxes

Paying property taxes doesn’t have to be a hassle. The Los Angeles County Tax Collector offers several convenient payment methods to suit your needs.

Online Payment

You can pay your property taxes online through the official website. It’s quick, secure, and saves you the trouble of mailing a check. Just make sure to pay before the deadlines to avoid penalties.

In-Person Payment

If you prefer the old-school method, you can pay in person at one of the Tax Collector’s offices. Bring your tax bill and a valid form of payment, and you’re good to go.

Choose the option that works best for you and stay on top of your payments.

Consequences of Not Paying Property Taxes

Skipping property tax payments can lead to serious consequences. The Los Angeles County Tax Collector takes delinquent accounts seriously, and here’s what could happen:

Penalties and Interest Charges

If you miss the payment deadlines, you’ll face penalties and interest charges. These can add up quickly, making it even harder to catch up. The longer you wait, the more it will cost you.

Tax Liens and Foreclosure

In extreme cases, failure to pay property taxes can result in tax liens or even foreclosure. This is why staying current on your payments is so important. Don’t let it get to this point – take action if you’re struggling to pay.

Remember, the Tax Collector’s Office is there to help. If you’re facing financial difficulties, reach out to them to discuss possible solutions.

Resources for Property Owners in Los Angeles County

There are plenty of resources available to help you navigate property taxes in LA County. Here are a few you should know about:

Official Los Angeles County Tax Collector Website

Visit the official website for the most up-to-date information on property taxes. You can find everything from tax rates to payment options and appeal procedures.

Local Tax Consultants

If you need personalized advice, consider hiring a local tax consultant. They can help you understand your obligations and find ways to reduce your tax burden.

Utilize these resources to stay informed and make the most of your property ownership experience.

Tips for Managing Property Taxes

Managing property taxes doesn’t have to be overwhelming. Here are a few tips to help you stay organized:

- Set reminders for payment deadlines.

- Keep records of all tax-related documents.

- Review your tax bill carefully for errors.

- Explore available exemptions and deductions.

By following these tips, you’ll be better prepared to handle your property tax responsibilities.

Conclusion

Understanding Los Angeles County Tax Collector property tax is essential for every homeowner. By knowing how taxes are calculated, staying on top of deadlines, and taking advantage of available exemptions, you can manage your property taxes with ease.

Don’t forget to use the resources provided by the Tax Collector’s Office and seek professional advice if needed. Remember, paying property taxes is not just a legal obligation; it’s also an investment in your community.

Now that you’re equipped with all the knowledge, it’s time to take action. Share this article with fellow homeowners, leave a comment with your thoughts, and explore more articles on our site. Together, let’s make property tax management less intimidating and more manageable!

Table of Contents

- Understanding the Role of Los Angeles County Tax Collector

- How Property Taxes Are Calculated in Los Angeles County

- Property Tax Deadlines You Need to Know

- Exemptions and Deductions for Property Owners

- Challenging Your Property Tax Assessment

- Payment Options for Property Taxes

- Consequences of Not Paying Property Taxes

- Resources for Property Owners in Los Angeles County

- Tips for Managing Property Taxes

- Conclusion

Los Angeles County Property Tax Website

Los Angeles County Tax Collector change comin

la county tax collector mailing address Vinita Witt