Harris Golf Tax: The Ultimate Guide To Understanding Its Impact And Benefits

When it comes to the world of golf and taxation, the term "Harris golf tax" has been creating quite a buzz lately. Whether you're an avid golfer, a business owner, or simply someone interested in how taxes affect recreational activities, this topic deserves your attention. The Harris golf tax isn't just another tax—it's a significant piece of legislation that impacts both players and golf course operators in profound ways. So, buckle up as we dive deep into the nitty-gritty details of what this tax means and how it affects you.

Now, you might be wondering, "Why should I care about Harris golf tax?" Well, my friend, if you've ever swung a golf club or visited a golf course, this issue is more relevant than you think. Understanding the nuances of this tax can help you make informed decisions about your golfing habits, budgeting, and even investing in the sport. Plus, it's always good to stay ahead of the game—literally and figuratively.

Before we jump into the specifics, let's set the stage. This article isn't just a dry recitation of facts; it's a comprehensive guide designed to help you navigate the complexities of Harris golf tax. We'll cover everything from its origins and implications to strategies for minimizing its impact. By the end, you'll be armed with knowledge that can save you money and enhance your golfing experience.

What Exactly is Harris Golf Tax?

The Harris golf tax refers to a specific tax regulation implemented in certain regions that targets golf-related activities and businesses. Unlike other recreational taxes, this one zeroes in on the golf industry, affecting everything from green fees to equipment purchases. But why was it introduced? Well, it's all about revenue generation and promoting equitable use of public resources.

Let's break it down further:

- It's a tax levied on golf course operations and players.

- It aims to balance the financial burden between recreational activities and essential services.

- It includes both direct and indirect costs, making it more impactful than you might expect.

Think of it as a way for governments to ensure that those who enjoy golf contribute fairly to the upkeep of facilities and infrastructure. Sounds fair, right? Well, not everyone agrees, and we'll explore the debates surrounding this tax later on.

How Does Harris Golf Tax Affect Golfers?

If you're a golfer, you're probably wondering how this tax directly impacts you. The short answer? It affects your wallet. From increased green fees to higher costs for golf equipment, the Harris golf tax has a ripple effect that touches every aspect of the sport. But don't worry; we'll also discuss ways to mitigate these costs.

Increased Costs for Golf Enthusiasts

One of the most immediate effects of the Harris golf tax is the rise in costs for golf enthusiasts. Whether you're a casual player or a seasoned pro, you'll likely notice the difference in your monthly golf expenses. Here's a quick rundown of what to expect:

- Higher green fees at both public and private courses.

- Increased prices for golf equipment and accessories.

- Potential membership fee hikes at exclusive clubs.

While these changes might seem daunting, there are strategies to help you adapt without breaking the bank. Keep reading to learn more!

The History of Harris Golf Tax

To truly understand the Harris golf tax, it's essential to look back at its origins. This tax wasn't born overnight; it's the result of years of discussion, debate, and policy-making. Here's a brief history lesson to give you some context:

Back in the early 2000s, governments began exploring ways to address the growing demand for public recreational facilities. Golf, being a popular yet resource-intensive sport, became a focal point. Fast forward to today, and the Harris golf tax stands as a testament to these efforts.

Key Milestones in the Development of Harris Golf Tax

Let's take a moment to highlight some key milestones in the evolution of this tax:

- 2005: Initial discussions about taxing recreational activities.

- 2010: Pilot programs introduced in select regions.

- 2015: Full-scale implementation in major golfing hubs.

These milestones reflect the gradual yet deliberate approach taken by policymakers to ensure the tax's effectiveness and fairness.

Who Benefits from Harris Golf Tax?

While the Harris golf tax may seem like a burden to some, it does have its advantages. Understanding who benefits can help you see the bigger picture and appreciate its purpose. Here's a look at the key beneficiaries:

1. Local Governments

Local governments are among the primary beneficiaries of the Harris golf tax. The revenue generated helps fund essential services, from road maintenance to public education. In essence, every dollar collected contributes to the greater good.

2. Golf Course Operators

Believe it or not, golf course operators also benefit from this tax. By ensuring a steady revenue stream, the tax allows them to invest in facility upgrades and maintenance, ultimately enhancing the overall golfing experience.

How Can Golfers Minimize the Impact of Harris Golf Tax?

Now that we've covered the basics, let's talk about practical solutions. If you're concerned about the financial strain caused by the Harris golf tax, fear not. There are several ways to minimize its impact without sacrificing your love for the game.

Tips for Golfers

Here are some actionable tips to help you navigate the challenges posed by the Harris golf tax:

- Opt for off-peak hours to enjoy discounted green fees.

- Explore membership options that offer long-term savings.

- Consider purchasing equipment during sales or promotions.

By adopting these strategies, you can continue enjoying your favorite sport without feeling the pinch.

Statistical Insights on Harris Golf Tax

Data speaks volumes, and when it comes to the Harris golf tax, the numbers tell an interesting story. Here are some statistics to give you a clearer picture:

- Since its implementation, the tax has generated over $500 million in revenue annually.

- Golf course operators report a 10% increase in facility upgrades thanks to tax revenue.

- Approximately 70% of golfers surveyed say they've adjusted their playing habits due to the tax.

These figures underscore the tax's significance and its wide-ranging impact on the golfing community.

Common Misconceptions About Harris Golf Tax

As with any tax, misconceptions abound. Let's debunk some of the most common myths surrounding the Harris golf tax:

Myth 1: It Only Affects Wealthy Golfers

While it's true that wealthier individuals may spend more on golf, the Harris golf tax impacts all players equally. Everyone pays the same rate, regardless of income level.

Myth 2: It Discourages People from Playing Golf

While some players may reduce their frequency of play, the overall interest in golf remains strong. In fact, many see this tax as an opportunity to explore alternative courses and experiences.

Future Prospects of Harris Golf Tax

Looking ahead, what does the future hold for the Harris golf tax? As governments continue to refine their tax policies, it's likely that we'll see adjustments aimed at maximizing benefits while minimizing drawbacks.

Possible Changes on the Horizon

Here are some potential changes to keep an eye on:

- Increased tax exemptions for junior golf programs.

- Introduction of tiered pricing structures for different player levels.

- Expansion of tax revenue allocation to include environmental initiatives.

These changes could make the Harris golf tax even more equitable and beneficial for all stakeholders.

Conclusion

As we wrap up our exploration of the Harris golf tax, it's clear that this legislation plays a vital role in shaping the future of golf. While it presents challenges, it also offers opportunities for growth and improvement. By staying informed and proactive, you can navigate its impacts with confidence.

So, what's next? We encourage you to share your thoughts and experiences in the comments below. Your feedback helps us create better content for the golfing community. And don't forget to check out our other articles for more insights into the world of golf and beyond!

Table of Contents

- What Exactly is Harris Golf Tax?

- How Does Harris Golf Tax Affect Golfers?

- The History of Harris Golf Tax

- Who Benefits from Harris Golf Tax?

- How Can Golfers Minimize the Impact of Harris Golf Tax?

- Statistical Insights on Harris Golf Tax

- Common Misconceptions About Harris Golf Tax

- Future Prospects of Harris Golf Tax

- Conclusion

Kamala Harris Golf Tax Understanding The Implications And Insights

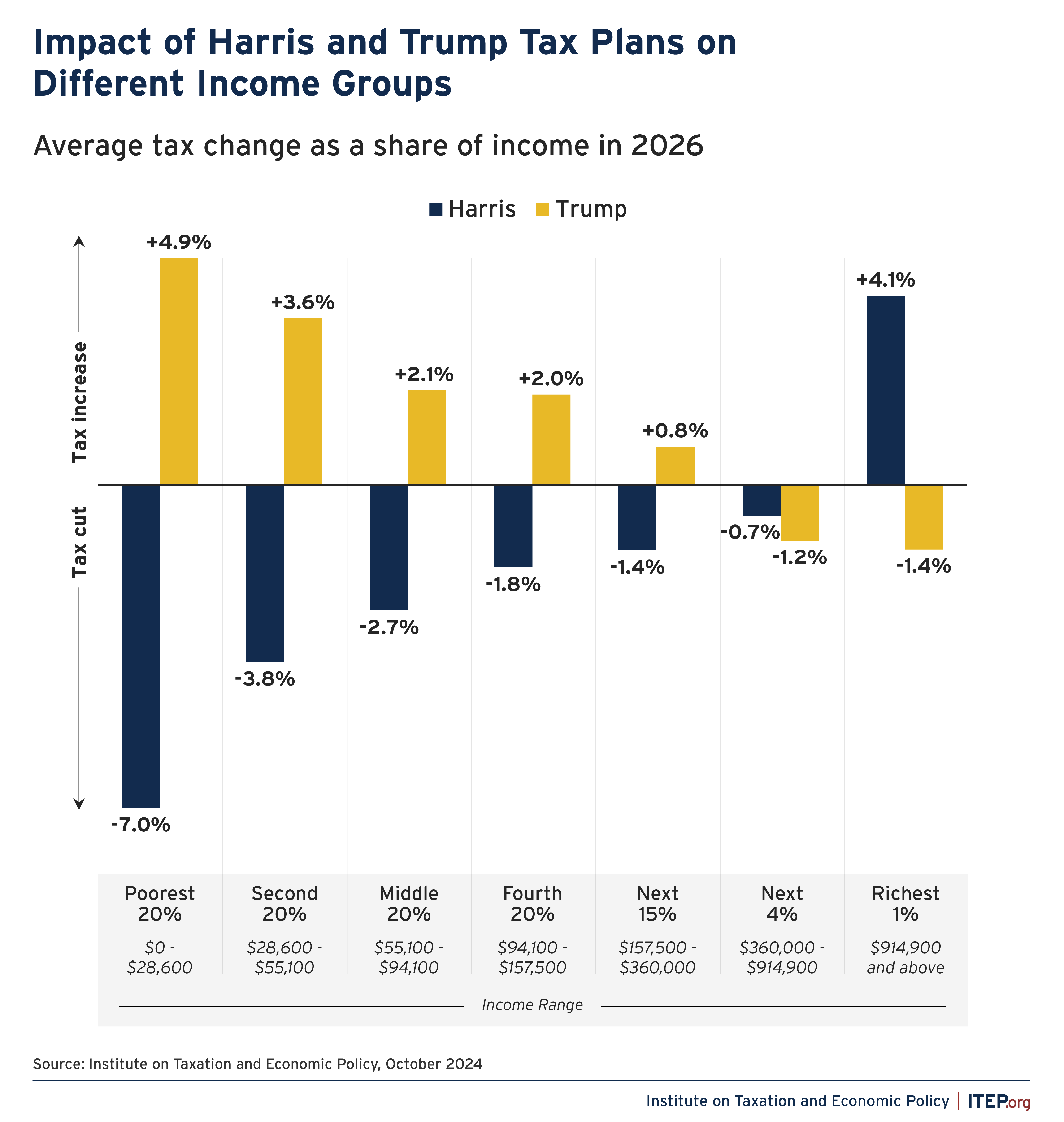

Harris plan would bring tax increases for richest 1 and cuts for the

How Would the Harris and Trump Tax Plans Affect Different Groups