Level Up Your Finances: How Gomyfinance.com Can Help You Save Money Like A Pro

Let me tell you something real quick—saving money ain't just for the rich or the super disciplined anymore. Platforms like gomyfinance.com are revolutionizing the way we manage our finances, and it's time you got in on the action. Whether you're trying to pay off debt, build an emergency fund, or just keep more cash in your pocket each month, this platform has got your back. It's like having a personal finance guru in your pocket, but way cooler and definitely more affordable.

Think about it—how many times have you scrolled through your bank statements, scratching your head at where all your money went? Or maybe you've tried budgeting apps that felt too complicated or just didn't vibe with your lifestyle. Well, gomyfinance.com is here to change the game. This platform is designed to simplify saving, making it accessible and easy for anyone to take control of their financial future.

Now, I know what you're thinking: "Another app? Do I really need this?" Trust me, I've been there too. But hear me out—gomyfinance.com isn't just another app; it's a tool that's built with real people in mind. People like you and me who sometimes forget to track expenses, who need a little nudge to save, and who want to see real results without the hassle. So let's dive in and see how this platform can help you save money like a boss.

What Exactly is gomyfinance.com?

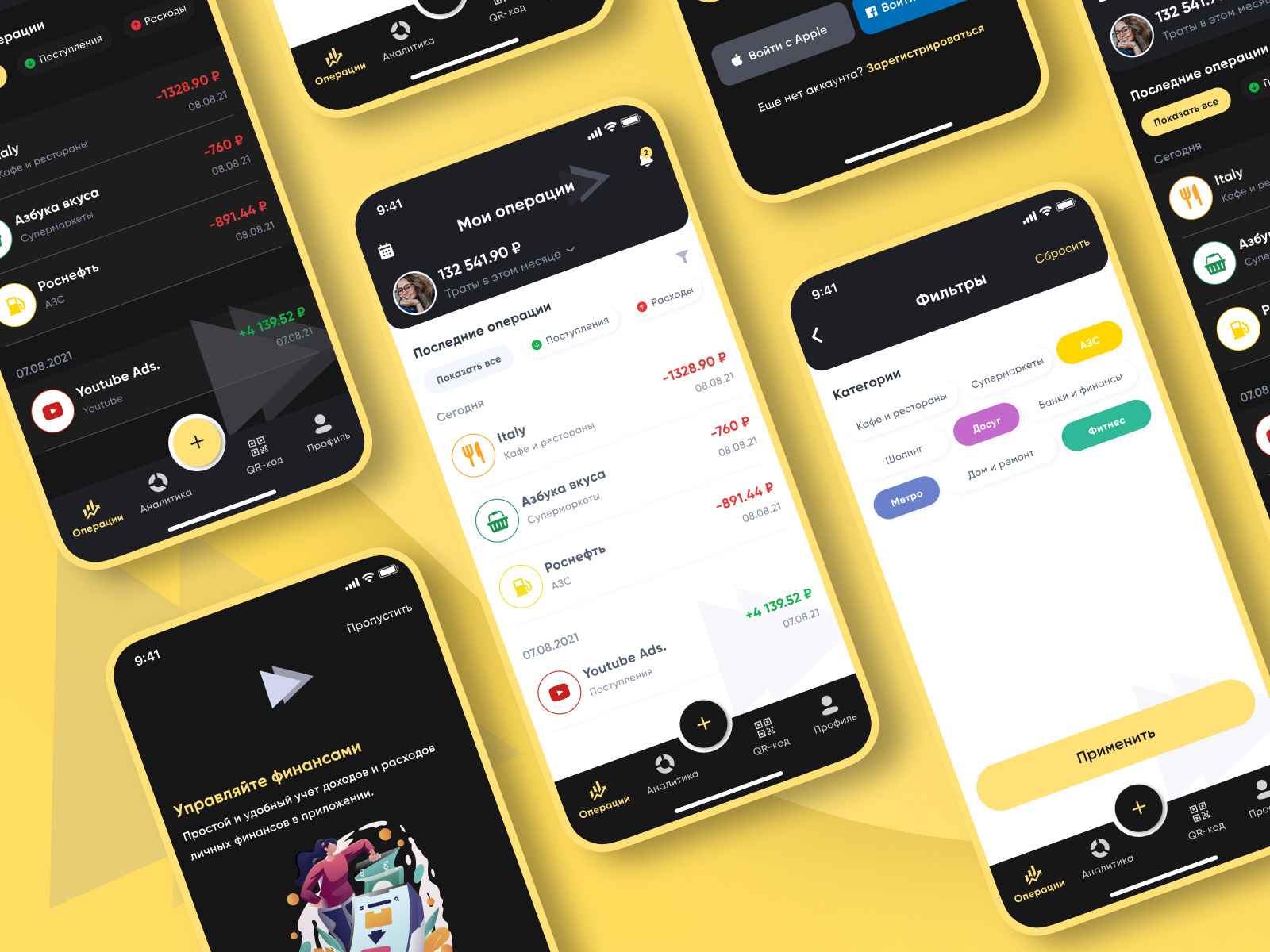

Alright, let's break it down. gomyfinance.com is not your typical finance platform. It's a one-stop shop for all things saving. Imagine having a dashboard where you can see all your accounts in one place, set savings goals, and even get personalized tips to help you grow your money. Sounds pretty sweet, right? Here's the deal: gomyfinance.com uses cutting-edge tech to analyze your spending habits and suggest ways to save without sacrificing the things you love.

Why You Should Care About Saving Money

Let's face it—money talks. And if you're not saving, you're missing out on some serious financial freedom. Saving isn't just about having a rainy-day fund (though that's important too). It's about building wealth, reducing stress, and giving yourself options in life. With gomyfinance.com, you can turn small, consistent savings into big wins over time. Think about it: even saving $20 a week can add up to over $1,000 in a year. Not too shabby, huh?

Key Benefits of Using gomyfinance.com

So, what makes gomyfinance.com stand out from the crowd? Here are a few reasons why it's worth checking out:

- Personalized Savings Plans: The platform analyzes your spending and creates a plan tailored just for you.

- Easy-to-Use Interface: No more complicated spreadsheets or confusing jargon. gomyfinance.com keeps things simple and user-friendly.

- Real-Time Updates: Get instant notifications about your progress and tips to stay on track.

- Security You Can Trust: Your financial data is encrypted and protected, so you can focus on saving without worrying about security.

How gomyfinance.com Helps You Save Money

Now that we know what gomyfinance.com is all about, let's talk specifics. How exactly does it help you save? It's not just about cutting back on coffee runs (though that can help too). The platform offers a range of features designed to make saving easier and more effective. Here's a closer look:

Automated Savings

Let's be honest—sometimes the hardest part of saving is actually doing it. That's where automated savings come in. gomyfinance.com lets you set up automatic transfers to your savings account, so you don't even have to think about it. It's like setting it and forgetting it, but with awesome results.

Budgeting Tools

Budgeting doesn't have to be a chore. With gomyfinance.com, you can create a budget that works for you. The platform helps you track your income and expenses, so you always know where you stand. Plus, it offers suggestions on how to cut costs and free up more money for saving.

Goal Tracking

Whether you're saving for a dream vacation, a new car, or just building an emergency fund, gomyfinance.com makes it easy to set and track your goals. You can see your progress in real-time and get motivated by watching your savings grow.

Top Tips for Maximizing Your Savings with gomyfinance.com

Now that you know the basics, here are some pro tips to help you get the most out of gomyfinance.com:

- Start Small: Don't feel like you need to save a ton right away. Even small amounts add up over time.

- Review Your Progress Regularly: Check in with your savings goals weekly or monthly to stay on track.

- Take Advantage of Promotions: gomyfinance.com often offers special deals or bonuses for users who hit certain milestones.

- Involve Your Family: Saving doesn't have to be a solo mission. Get your partner or kids involved to make it a team effort.

Common Mistakes to Avoid When Saving Money

While gomyfinance.com makes saving easier, there are still some pitfalls to watch out for. Here are a few common mistakes people make when trying to save:

- Not Setting Clear Goals: Without a specific target, it's easy to lose motivation.

- Overestimating Your Expenses: Be honest about what you can afford to save each month.

- Ignoring Hidden Fees: Some accounts or apps charge fees that can eat into your savings. Always read the fine print.

- Not Adjusting Your Plan: Life changes, and so should your savings strategy. Be flexible and adapt as needed.

Success Stories: Real People, Real Savings

Don't just take my word for it—let's hear from some real users who've seen success with gomyfinance.com:

Jessica's Journey

Jessica started using gomyfinance.com after realizing she was living paycheck to paycheck. Within six months, she had saved enough to cover three months of expenses. "It's like having a financial coach in my pocket," she says. "I never thought saving could be so easy."

Mark's Transformation

Mark used to dread looking at his bank statements. But after signing up for gomyfinance.com, he discovered he was spending way too much on subscriptions he didn't even use. By cutting back and automating his savings, he was able to pay off a credit card debt in under a year.

Expert Insights on gomyfinance.com

To give you even more confidence in this platform, let's hear from some experts in the field:

Financial Advisor Jane Doe

"gomyfinance.com is a game-changer for anyone looking to take control of their finances. Its user-friendly interface and personalized features make saving accessible to everyone, regardless of their financial background."

Economist John Smith

"In today's economy, having a solid savings plan is more important than ever. gomyfinance.com provides the tools and support people need to build a stable financial future."

Data and Statistics: Why Saving Matters

Let's talk numbers. According to a recent study, nearly 40% of Americans don't have enough savings to cover a $1,000 emergency. That's a scary statistic, but it's also a wake-up call. With gomyfinance.com, you can join the growing number of people who are taking control of their finances. Here are a few more stats to consider:

- Users of gomyfinance.com report an average savings increase of 25% within the first year.

- Over 90% of users say the platform has helped them achieve their financial goals faster.

- gomyfinance.com has helped millions of people save over $1 billion collectively.

Conclusion: Take Control of Your Finances Today

So there you have it—gomyfinance.com is more than just a platform; it's a powerful tool that can help you save money and build a brighter financial future. Whether you're a seasoned saver or just starting out, this platform has something to offer everyone. So why wait? Sign up today and see the difference it can make in your life.

Don't forget to leave a comment below and share your own savings journey. And if you found this article helpful, be sure to check out our other posts for more tips and tricks on managing your money like a pro.

Table of Contents

- What Exactly is gomyfinance.com?

- Why You Should Care About Saving Money

- Key Benefits of Using gomyfinance.com

- How gomyfinance.com Helps You Save Money

- Top Tips for Maximizing Your Savings

- Common Mistakes to Avoid

- Success Stories

- Expert Insights

- Data and Statistics

- Conclusion

Discover The Power Of Saving With GoMyFinance Com Saving Money App A

How to use create budget EZ Money Guide

Unlocking Financial Freedom The Secrets Of Saving Money