NYC City Income Tax: A Deep Dive Into What You Need To Know

Hey there, city dwellers and aspiring New Yorkers! If you’re reading this, chances are you’ve heard whispers about NYC city income tax. Let me break it down for you—this isn’t just another tax; it’s a big deal for anyone living or working in the Big Apple. Whether you’re a lifelong resident or a newcomer, understanding how NYC city income tax works is crucial. So, buckle up because we’re diving headfirst into the world of New York City taxes, and trust me, it’s gonna be a wild ride!

Now, before we dive into the nitty-gritty, let’s get one thing straight: New York City income tax is not optional. If you’re earning money within city limits, Uncle Sam and the city itself want their fair share. This isn’t about being a buzzkill; it’s about equipping you with the knowledge to navigate the financial labyrinth that is NYC taxation. Think of this article as your personal guide to staying on top of your finances while enjoying all the city has to offer.

One last thing before we move on: this isn’t just about numbers and percentages. It’s about understanding how these taxes impact your wallet, your lifestyle, and your future in the city. Ready to dig in? Let’s do this!

What Is NYC City Income Tax?

Alright, let’s start with the basics. NYC city income tax is a tax levied by the city of New York on individuals who earn income within its borders. Unlike some other cities that have a flat tax rate, NYC uses a progressive tax system, meaning the more you earn, the more you pay. Simple enough, right? Well, not exactly. There are nuances, exemptions, and deductions that can make things a little tricky.

How Does NYC City Income Tax Work?

The mechanics of NYC city income tax are pretty straightforward once you break them down. First, the city determines your taxable income based on your federal adjusted gross income (AGI). Then, it applies a series of tax brackets to calculate how much you owe. For example, if you’re single and your taxable income falls between $12,000 and $25,000, you’ll pay 3.078% in city income tax. But if you’re earning over $500,000, that rate jumps to 3.876%. Makes sense?

Oh, and don’t forget: NYC city income tax is in addition to federal and state taxes. Yep, you read that right. New Yorkers are hit with a triple whammy when it comes to taxation. But hey, living in the greatest city in the world comes with a price tag, right?

Who Needs to Pay NYC City Income Tax?

Here’s the million-dollar question: do you have to pay NYC city income tax? The short answer is yes—if you live or work in the city. But let’s break it down further. Residents of New York City are required to pay city income tax on all income earned, regardless of where the income originates. Non-residents, on the other hand, only pay city income tax on income earned within the city limits. Clear as mud, right?

Resident vs. Non-Resident Taxpayers

Let’s clarify the difference between resident and non-resident taxpayers. Resident taxpayers are those who maintain a permanent home in the city and spend more than 183 days there annually. Non-resident taxpayers are those who work in the city but don’t meet the residency requirements. The distinction matters because it affects how much tax you owe and what deductions you can claim.

NYC City Income Tax Rates

Now, let’s talk numbers. NYC city income tax rates vary depending on your filing status and income level. For the 2023 tax year, the rates range from 3.078% to 3.876%. Here’s a quick breakdown:

- Single filers: $0 - $12,000 = 3.078%

- Single filers: $12,001 - $25,000 = 3.817%

- Single filers: $25,001 - $500,000 = 3.817%

- Single filers: Over $500,000 = 3.876%

And that’s just for singles. Married couples filing jointly have their own set of brackets. It’s a lot to take in, but trust me, it’s worth understanding these rates if you want to plan your finances effectively.

How to Calculate NYC City Income Tax

Calculating NYC city income tax might sound intimidating, but it’s actually pretty straightforward. All you need is your AGI and a copy of the NYC tax brackets. Start by subtracting any deductions or exemptions to determine your taxable income. Then, apply the appropriate tax rate based on your filing status and income level. Voilà! You’ve just calculated your NYC city income tax.

Using Tax Software or a Professional

If math isn’t your strong suit, don’t worry. You can always use tax software or hire a professional to do the heavy lifting for you. Programs like TurboTax and H&R Block make the process a breeze, and accountants can offer personalized advice tailored to your financial situation. It’s all about finding what works best for you.

Common Deductions and Exemptions

Before you start panicking about how much you owe, remember that there are deductions and exemptions to help lower your NYC city income tax bill. Some common deductions include contributions to retirement plans, student loan interest, and certain business expenses. Exemptions, on the other hand, are reductions in taxable income based on factors like age, disability, or military service.

How to Claim Deductions and Exemptions

Claiming deductions and exemptions is as easy as filling out the right forms. For NYC city income tax, you’ll need to complete Form IT-201 or IT-201-NR, depending on your residency status. Be sure to gather all necessary documentation, such as W-2s, 1099s, and receipts for deductible expenses. The more organized you are, the smoother the process will be.

Penalties for Not Paying NYC City Income Tax

Now, let’s talk about the consequences of not paying your NYC city income tax. If you fail to file or pay your taxes on time, you could face penalties and interest charges. The city doesn’t mess around when it comes to collecting what’s owed. Penalties can range from 5% of the unpaid tax to as much as 25%, depending on the severity of the offense. So, do yourself a favor and stay on top of your tax obligations.

Avoiding Penalties and Interest

The best way to avoid penalties and interest is to file and pay your taxes on time. If you’re unable to meet the deadline, consider filing for an extension or setting up a payment plan. The city offers several options to help taxpayers who are struggling to pay their bills. Communication is key—don’t be afraid to reach out if you need assistance.

Tips for Managing NYC City Income Tax

Managing NYC city income tax doesn’t have to be a headache. Here are a few tips to help you stay organized and stress-free:

- Keep detailed records of all income and expenses.

- Set aside a portion of your income specifically for taxes.

- Consult with a tax professional if you’re unsure about anything.

- Stay informed about changes to tax laws and regulations.

By following these tips, you’ll be well-prepared to handle your NYC city income tax responsibilities with ease.

Conclusion

And there you have it—a comprehensive guide to NYC city income tax. From understanding the basics to calculating your tax bill and claiming deductions, we’ve covered it all. Remember, knowledge is power, and being informed about your tax obligations is the first step toward financial success in the city.

So, what’s next? Take action! Whether it’s filing your taxes, consulting with a professional, or simply brushing up on the latest tax laws, make sure you’re doing everything you can to stay ahead of the curve. And don’t forget to share this article with your friends and family—after all, knowledge is meant to be shared!

Table of Contents

- What Is NYC City Income Tax?

- How Does NYC City Income Tax Work?

- Who Needs to Pay NYC City Income Tax?

- NYC City Income Tax Rates

- How to Calculate NYC City Income Tax

- Common Deductions and Exemptions

- Penalties for Not Paying NYC City Income Tax

- Tips for Managing NYC City Income Tax

- Conclusion

2021 nyc tax brackets fopttokyo

working in nyc taxes Tommie Kelleher

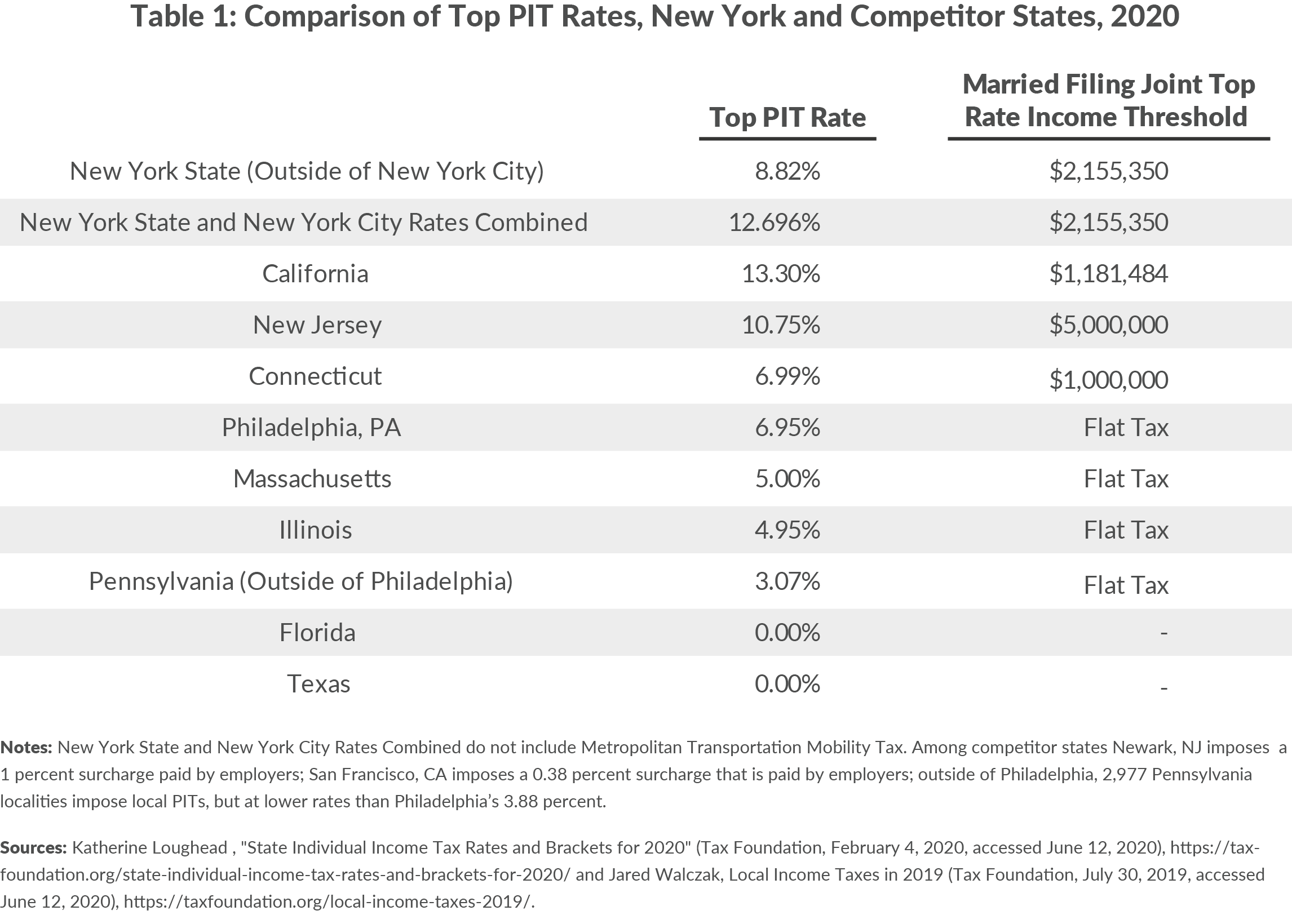

New York Budget Gap Options for Addressing New York Revenue Shortfall