Mastering Term Bills: A Comprehensive Guide To Understanding And Managing Your Finances

Let's talk about term bills, shall we? These little financial nuggets play a crucial role in our day-to-day lives, whether we're aware of it or not. From utility payments to subscription services, term bills are the silent architects of our budgets. But what exactly are they, and why should you care? Well, buckle up, because we're diving headfirst into the world of term bills, and trust me, it's more exciting than it sounds.

Imagine this: You're sitting at your kitchen table, coffee in hand, scrolling through your bank statements. You notice a bunch of recurring charges labeled as "term bills." Now, you might be wondering, "What are these things, and why do they keep showing up?" Fear not, my friend, because understanding term bills is the first step toward taking control of your financial destiny. In this article, we'll break it down for you in a way that's easy to digest, so you can make smarter financial decisions.

But wait, there's more! Understanding term bills isn't just about knowing what they are. It's about learning how they fit into the bigger picture of your financial health. Whether you're a seasoned budget guru or just starting your financial journey, this guide has something for everyone. So, let's get started, shall we?

What Are Term Bills Anyway?

Alright, let's start with the basics. Term bills, in simple terms, are payments that you make on a regular schedule over a set period. Think of them like the rent you pay every month or the insurance premiums that keep your car protected. These bills are predictable, which makes them easier to plan for, but they can also sneak up on you if you're not paying attention.

Here's the kicker: Term bills aren't just about the money you owe. They're also about the services or benefits you receive in return. For example, when you pay your internet bill, you're not just handing over cash; you're getting access to the digital world. It's a two-way street, and understanding both sides of the equation is key to managing your finances effectively.

Why Term Bills Matter in Your Life

Now that we've defined term bills, let's talk about why they're so important. First off, they're a major part of your monthly expenses. If you don't keep an eye on them, they can quickly spiral out of control, leaving you scrambling to make ends meet. But here's the good news: By understanding your term bills, you can create a budget that works for you, not against you.

Plus, managing your term bills effectively can improve your credit score. When you pay your bills on time, it shows lenders that you're responsible and reliable. This can open doors to better interest rates on loans and credit cards, which can save you a ton of money in the long run. So, yeah, term bills matter, big time.

How Term Bills Impact Your Financial Health

Let's dive a little deeper into how term bills affect your overall financial well-being. Picture your finances as a seesaw. On one side, you've got your income, and on the other, you've got your expenses. Term bills are a big chunk of that expense side, and if they get too heavy, the seesaw tips, leaving you in a financial bind.

But here's the thing: Term bills aren't all bad. They can actually work in your favor if you manage them wisely. For instance, if you have a gym membership that you use regularly, that term bill is an investment in your health. Or if you have a streaming service that keeps you entertained, it's an investment in your happiness. The key is to make sure that each term bill you pay is adding value to your life in some way.

Identifying Your Term Bills

Before you can manage your term bills, you need to know what they are. Take a few minutes to go through your bank statements and highlight all the recurring charges. These are your term bills. Some common examples include:

- Rent or mortgage payments

- Utility bills (electricity, water, gas)

- Internet and phone services

- Insurance premiums

- Subscription services (streaming, gym memberships)

Once you've identified your term bills, you can start categorizing them. Which ones are essential, and which ones can you live without? This will help you prioritize your spending and make smarter financial decisions.

Strategies for Managing Term Bills

Now that you know what term bills are and why they matter, let's talk about how to manage them. The first step is to create a budget. I know, I know, budgeting sounds boring, but trust me, it's your best friend when it comes to managing your finances. Start by listing all your income and expenses, including your term bills. Then, allocate a specific amount for each category.

Another great strategy is to automate your payments. Most service providers offer automatic billing, which means you never have to worry about missing a payment. Plus, some companies even offer discounts for setting up auto-pay. It's a win-win situation.

Negotiating Term Bills

Did you know that you can negotiate your term bills? It's true! Many companies are willing to work with you to lower your rates, especially if you've been a loyal customer. All it takes is a phone call or an email. Just be polite, explain your situation, and ask if there's any way they can help. You'd be surprised how often this works.

The Importance of Reviewing Your Term Bills

One of the biggest mistakes people make is assuming that their term bills are set in stone. Newsflash: They're not! Things change, and so should your term bills. Regularly reviewing your bills can help you catch errors, identify areas where you can save money, and ensure that you're still getting the best deal possible.

For example, let's say you've had the same internet provider for years. Have you checked to see if there are better deals out there? Chances are, there are. Don't be afraid to shop around and switch providers if it means saving money. Your wallet will thank you.

Using Technology to Track Term Bills

We live in a digital age, and there are tons of apps and tools that can help you track your term bills. From budgeting apps to bill payment reminders, these tools can make managing your finances a breeze. Some popular options include Mint, YNAB (You Need A Budget), and PocketGuard. They all offer different features, so do your research and find the one that works best for you.

Common Mistakes to Avoid with Term Bills

Even the best of us make mistakes when it comes to managing term bills. One of the biggest errors is ignoring them altogether. Out of sight, out of mind, right? Wrong! Ignoring your bills can lead to late payments, fees, and even damage to your credit score. So, stay on top of them, folks!

Another common mistake is overspending on non-essential term bills. Do you really need that premium streaming package if you're only watching one show? Probably not. Be honest with yourself about what you need versus what you want, and adjust your spending accordingly.

How to Avoid Term Bill Overload

Term bill overload happens when you have too many recurring charges and not enough money to cover them. To avoid this, start by setting limits on how many term bills you can comfortably manage. Then, review your subscriptions regularly and cancel any that you're not using. It's a simple process, but it can make a big difference in your financial health.

Expert Tips for Reducing Term Bills

Here's where the real magic happens. If you're looking to reduce your term bills, there are a few expert tips that can help. First, consider bundling services. Many providers offer discounts if you bundle your internet, phone, and TV services together. It's a great way to save money without sacrificing quality.

Another tip is to switch to a prepaid model whenever possible. For example, instead of paying a monthly gym membership, consider paying for individual classes or using a pay-as-you-go model. This gives you more control over your spending and can save you a ton of money in the long run.

Long-Term Benefits of Managing Term Bills

Managing your term bills isn't just about saving money today; it's about securing your financial future. By taking control of your expenses, you can build a solid financial foundation that will serve you well in the years to come. Plus, you'll have more peace of mind knowing that your finances are in order.

Final Thoughts: Taking Control of Your Term Bills

And there you have it, folks! A comprehensive guide to understanding and managing your term bills. Remember, term bills are a part of life, but they don't have to control your life. By following the strategies outlined in this article, you can take control of your finances and create a brighter financial future for yourself.

So, what are you waiting for? Go ahead and review your term bills today. Identify areas where you can save money, and make the necessary changes. Your wallet will thank you, and so will your future self. And don't forget to share this article with your friends and family. Knowledge is power, and the more people who understand term bills, the better off we all are.

Table of Contents

- What Are Term Bills Anyway?

- Why Term Bills Matter in Your Life

- How Term Bills Impact Your Financial Health

- Strategies for Managing Term Bills

- The Importance of Reviewing Your Term Bills

- Common Mistakes to Avoid with Term Bills

- Expert Tips for Reducing Term Bills

- Long-Term Benefits of Managing Term Bills

- Final Thoughts: Taking Control of Your Term Bills

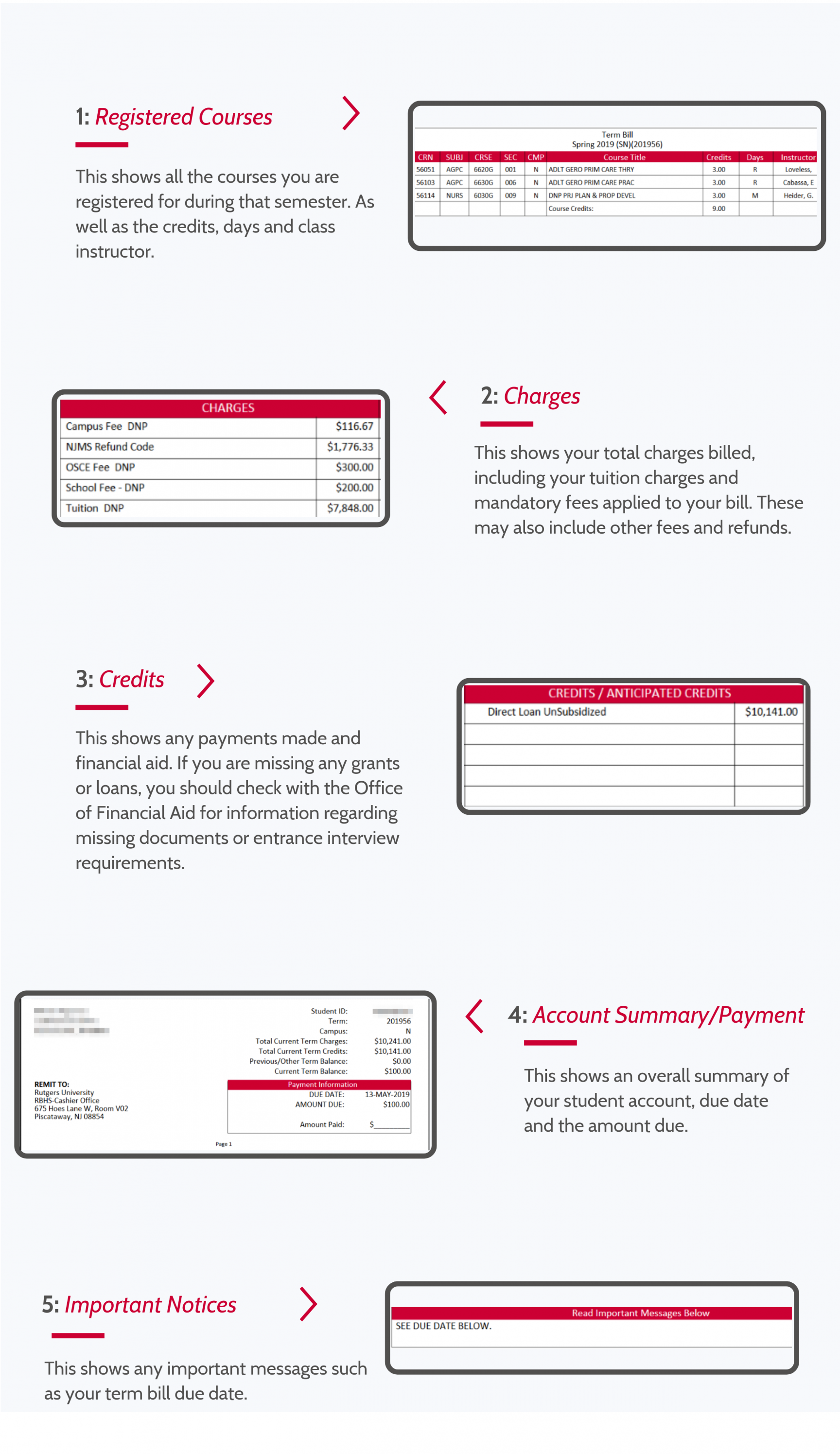

Understanding Your Term Bill University Finance and Administration

Term Bill help r/rutgers

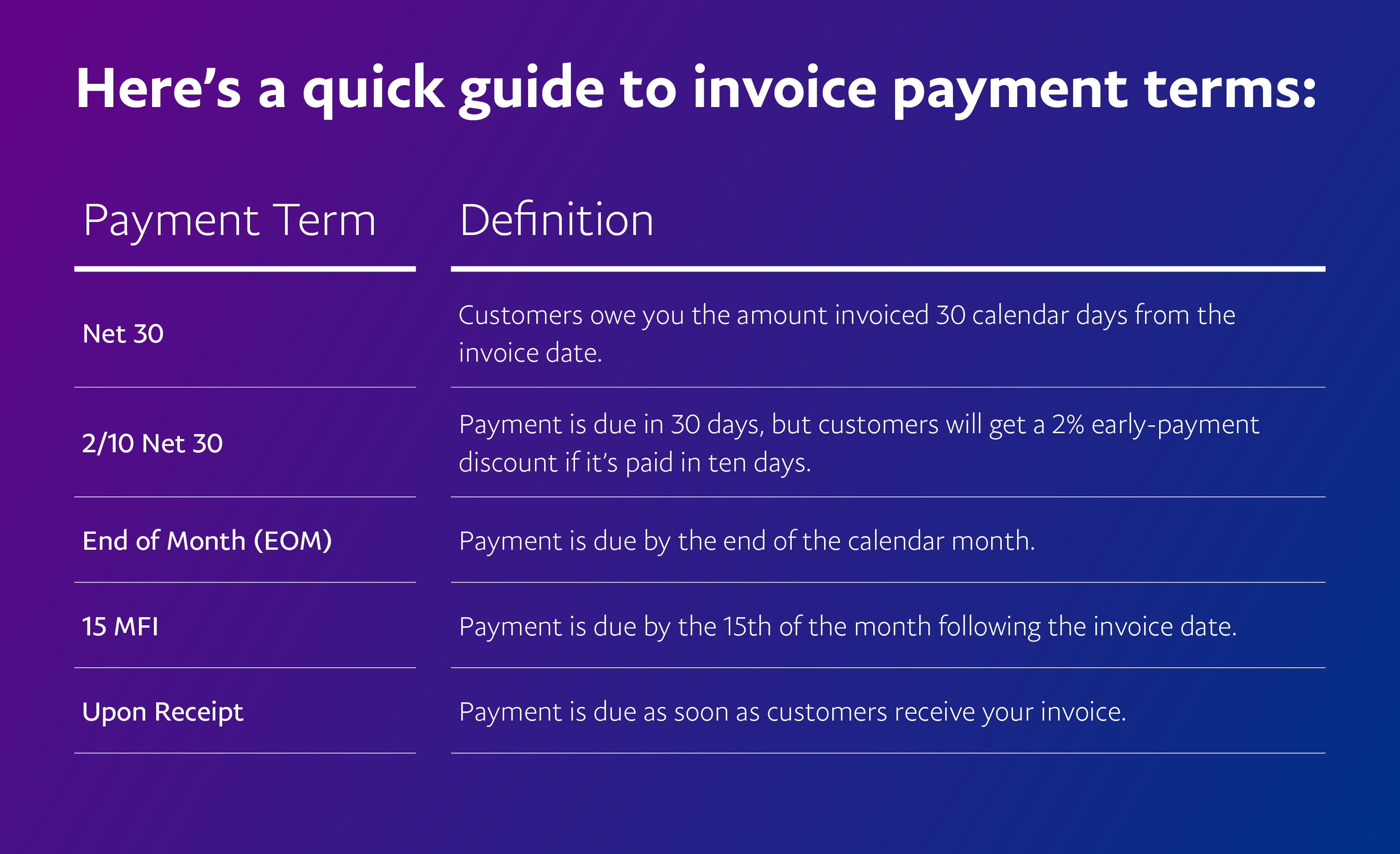

A quick guide to understand invoice payment terms PayPal